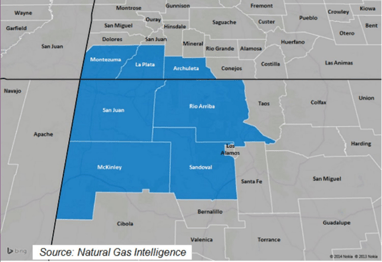

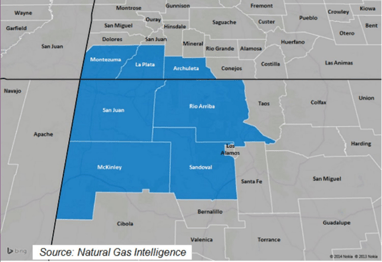

The San Juan Basin offers many investment opportunities, as it contains the largest coal-bed methane field in the world and ranks second in total gas reserves. This spotlight provides geological facts, current activity and things to know beforehand.

Background

The first oil well in the San Juan Basin spud in 1911, and since then over 40,000 wells have been drilled. Drilling activity was steady from the 1990s until 2008. In 2007, there were over 40 active rigs. Then attention turned to the prolific Marcellus, where gas could be extracted less expensively. In the past 12 months, 135 wells were completed in the Basin. The leading players include BP America, Hilcorp Energy Company, Catamount Energy Partners, and Encana Oil & Gas.

Mancos Shale and Gallup Sands

Improved drilling technology and renewed attention to the Mancos Shale and Gallup Sands are sparking increased interest in this area. The Mancos Shale lies under the Mesaverde and runs north to south, primarily covering areas of northwestern New Mexico into southwestern Colorado. While it is primarily a gas play, it becomes more oil prone as it moves south of the San Juan Basin. Its thickness is estimated to be almost 4,000 feet in places, with at least five continuous assessment units (per the USGS).

Regional highlights

The following highlights are worth bearing in mind from an investment perspective:

- A recent USGS survey estimates the Mancos in the Piceance Basin alone holds more than 66 trillion cubic feet of recoverable natural gas. By comparison, the Marcellus is estimated to hold 84 trillion cubic feet of gas.

- The potential could be compared to the Permian Basin with many stacked plays; and with the use of multi-stage fracking, the development of these plays may trend towards economical.

- The Gallup formation is the primary un-conventional target formation. It has geological similarities to the Turner sand in the Powder River Basin and the Codell in the DJ Basin.

- Conventional horizons include the Mesa Verde, Pictured Cliffs and Dakota formations. The Fruitland Coal formation supports significant coalbed methane production.

- Hilcorp San Juan LP secured 9 permits to drill horizontal wells from October 2018 to February 2019.

In addition, private equity funding ramped up in 2017 with some of the biggest names investing:

- NGP-backed Enduring Resources IV acquired assets in San Juan Co., Sandoval Co., and Rio Arriba Co., NM. covering 105,000 net acres in San Juan basin with 335 drilling locations. Enduring acquired the asset from WPX Energy for $700 million in February of 2018. The company continued to pick up additional acreage throughout 2018.

- Bison Oil & Gas Partners II has approximately 1,500 net acres between Sandoval Co., NM and San Juan Co., NM in its Cayote asset. The company received initial equity from Carnelian Energy Capital in 2017 and has articulated plans to continue development throughout 2019.

- Hilcorp San Juan LP acquired assets in 5 counties for $2.7 billion from ConocoPhillips including 1.3 million net acres. The company has bolted on additional acreage in San Juan Co., NM and Rio Arriba Co., NM and operates one rig.

- DJR Energy is a San Juan Basin-focused player, backed by Trilantic Capital Partners, Waveland Energy Partners and Global Energy Capital. In October, 2018, the company agreed to purchase 182,000 net acres targeting the Tocito and El Vado formations in three counties in New Mexico from Encana. DJR's position is now estimated at 352,000 net acres in the San Juan Basin.

What newcomers should know

Despite increased activity in the San Juan Basin, the time to obtain drilling permit approval can be lengthy due to the BLM process. One must also take into consideration that the basin is made up of large areas of federal, state and Indian lands. Furthermore, environmental groups are also very active there, so public relations is a must and has to be factored into the cost of developing the acreage. Finally, fee title in this area is often complex, with vintage vertical wells holding fee acreage for decades and convoluted heirship needing to be sorted out. Cinco's land management experts can help you navigate these nuanced situations.

For questions regarding mineral title matters or acquisitions in this area, please contact us.